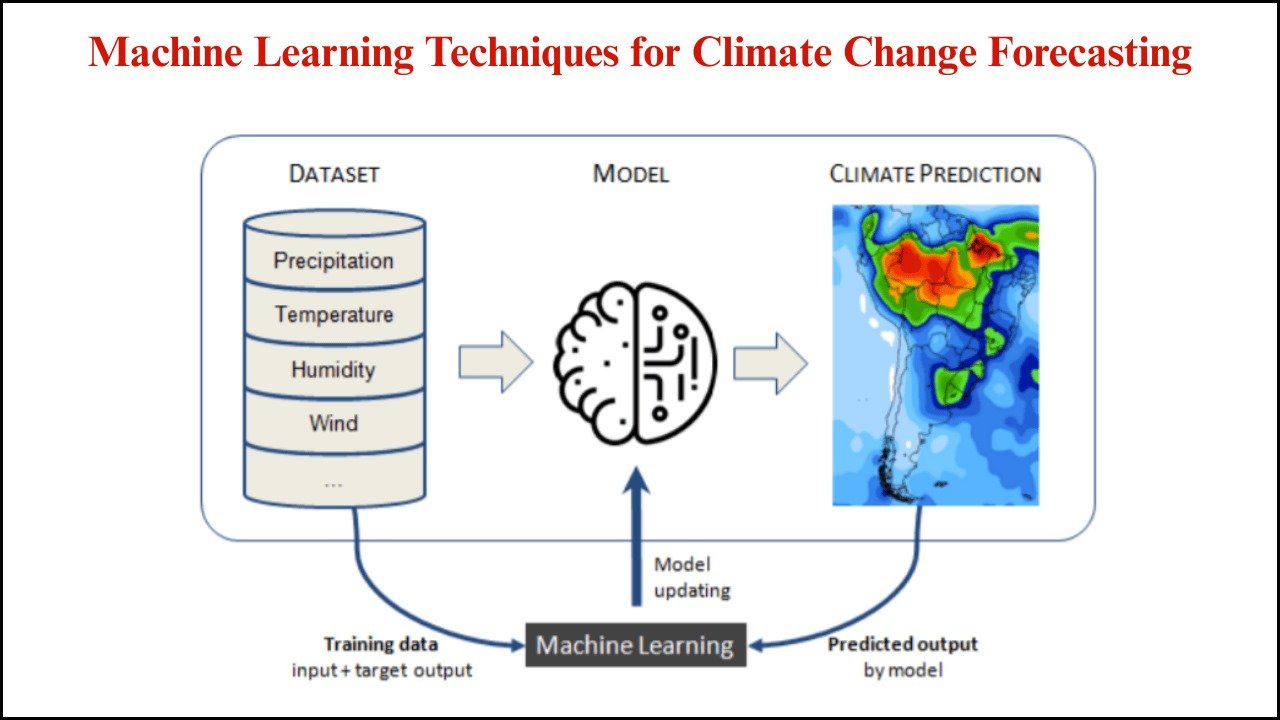

Machine learning is becoming an essential tool for central banks as they navigate increasingly complex financial systems, large volumes of data, and the need for timely policy decisions. Central banks are expected to ensure economic stability, monitor systemic risks, and regulate financial institutions effectively. Machine learning provides new opportunities to improve forecasting, detect fraud, and identify market trends.

However, the application of such technologies in highly sensitive environments is not free from challenges. Data reliability, regulatory implications, model transparency, and resource limitations create significant barriers. Best practices, when adopted carefully, help central banks integrate machine learning responsibly into their frameworks.

Table of Contents

Key Challenges in Machine Learning for Central Banks

- Data Quality and Availability

- Financial data is often fragmented, inconsistent, or incomplete.

- Sensitive macroeconomic data may not be updated frequently enough for real-time analysis.

- Central banks face restrictions on accessing proprietary financial datasets.

- Model Transparency and Interpretability

- Machine learning models, especially deep learning, act as “black boxes.”

- Lack of interpretability limits the ability of policymakers to trust model outcomes.

- Regulatory environments require explainability in decision-making.

- Cybersecurity and Data Privacy

- Handling confidential financial and personal information increases risks.

- Data breaches could undermine trust in central banks.

- Compliance with international privacy regulations is mandatory.

- Resource and Skills Gap

- Central banks often face difficulty in attracting AI and ML talent.

- Legacy IT infrastructure may not support high-compute ML applications.

- Continuous upskilling of staff is required.

- Bias and Fairness Issues

- Models trained on biased financial datasets may reinforce systemic inequalities.

- Fairness in credit risk assessment and fraud detection is critical.

- Errors could disproportionately affect small institutions or underserved populations.

- Integration with Traditional Models

- Economic forecasting relies heavily on traditional econometric models.

- Integration of ML models with established macroeconomic frameworks is complex.

- Discrepancies between statistical and machine learning results create conflicts.

- Regulatory and Legal Uncertainty

- Lack of uniform regulatory standards for AI adoption in financial supervision.

- Ethical concerns around automation in decision-making.

- Cross-border data sharing remains legally challenging.

Best Practices in Applying Machine Learning for Central Banks

- Develop Robust Data Governance

- Establish data-sharing agreements with financial institutions.

- Standardize data formats and adopt high-quality data pipelines.

- Ensure compliance with data protection laws.

- Adopt Explainable AI (XAI)

- Use interpretable models where possible, such as decision trees or linear models.

- Implement post-hoc explanation tools for complex models.

- Provide policymakers with transparent visualizations of model outputs.

- Strengthen Cybersecurity Protocols

- Apply advanced encryption for sensitive datasets.

- Regularly audit ML systems for vulnerabilities.

- Develop incident response frameworks.

- Invest in Capacity Building

- Establish specialized machine learning research units.

- Offer continuous training programs for economists and data scientists.

- Collaborate with universities and private sector institutions for expertise.

- Address Fairness and Ethical Considerations

- Perform fairness audits on ML models before deployment.

- Include diverse datasets that represent various economic segments.

- Set ethical guidelines for responsible AI adoption.

- Hybrid Modeling Approach

- Combine machine learning with traditional econometrics.

- Use ML to complement, not replace, economic theory-driven models.

- Apply ensemble approaches for improved accuracy and reliability.

- Regulatory Collaboration and Transparency

- Work closely with global financial regulators to align on AI standards.

- Publish guidelines on acceptable AI practices for financial institutions.

- Encourage open dialogue with stakeholders for trust-building.

Detailed Comparison of Challenges and Best Practices

| Challenge | Description | Best Practice |

|---|---|---|

| Data Quality Issues | Fragmented, incomplete, and outdated datasets limit the reliability of ML outputs. | Build robust data governance frameworks and standardize financial data pipelines. |

| Model Transparency | The Black-box nature of ML limits trust in decision-making processes. | Implement Explainable AI methods and ensure policymakers receive clear interpretations. |

| Cybersecurity Risks | Sensitive financial and personal data increase exposure to cyber threats. | Adopt strong encryption, conduct security audits, and establish response protocols. |

| Skills Gap | Shortage of AI experts and outdated IT infrastructure reduces implementation effectiveness. | Create specialized ML teams, train central bank staff, and collaborate with academia. |

| Bias in Models | Historical and biased datasets may reinforce inequalities in financial systems. | Conduct fairness audits, diversify datasets, and develop ethical AI guidelines. |

| Integration Difficulties | Traditional econometrics and ML may produce conflicting outcomes. | Use hybrid approaches combining both methods for balanced insights. |

| Regulatory Uncertainty | Lack of clear AI standards leads to compliance risks. | Collaborate with regulators and publish clear AI adoption guidelines. |

Applications of Machine Learning in Central Banking

- Monetary Policy Forecasting

- Machine learning improves short-term inflation and GDP forecasting.

- Algorithms detect hidden patterns in macroeconomic data that econometric models may overlook.

- Financial Stability Monitoring

- Models identify early warning signals of banking crises.

- ML helps detect unusual transaction patterns indicating systemic risks.

- Fraud Detection and Anti-Money Laundering (AML)

- Central banks monitor suspicious financial activities with anomaly detection models.

- ML supports real-time screening of large transaction volumes.

- Credit Risk Assessment

- Machine learning enhances risk scoring of financial institutions.

- Better models allow early detection of potential defaults.

- Operational Efficiency

- Automating repetitive tasks saves time and resources.

- Chatbots and AI assistants support communication with financial institutions.

Examples of Global Central Bank Practices

| Central Bank | Machine Learning Application | Outcome |

|---|---|---|

| European Central Bank (ECB) | ML for systemic risk monitoring | Improved identification of vulnerabilities in banking systems |

| Bank of England | Natural language processing for policy document analysis | Faster extraction of insights from unstructured data |

| Federal Reserve (USA) | ML in credit risk modeling | Better prediction of default risks |

| Monetary Authority of Singapore (MAS) | Fraud detection and AML monitoring | Enhanced compliance and reduced illicit transactions |

| Reserve Bank of India (RBI) | ML for inflation forecasting | More accurate short-term monetary policy planning |

Future Directions

- Integration of real-time big data streams (satellite data, social media trends) into ML systems.

- Use of federated learning to enhance collaboration without compromising data privacy.

- Expansion of AI-driven simulations for stress-testing financial institutions.

- Stronger emphasis on international cooperation for AI regulation and ethical standards.

Last Words

Machine learning represents a transformative opportunity for central banks to improve decision-making, strengthen financial stability, and enhance operational efficiency. Challenges such as data quality, bias, cybersecurity, and transparency remain significant barriers. However, by adopting best practices that prioritize explainability, fairness, and regulatory alignment, central banks can responsibly integrate machine learning into their frameworks.

Careful implementation ensures that technology acts as a complement to, rather than a replacement for, traditional economic expertise. The future of central banking will likely involve hybrid systems where machine learning and human judgment work together to maintain financial stability and public trust.